does texas have an inheritance tax 2019

You are required to file a state business income tax return in. Near the end of the interview procedure TurboTax stated.

Texas Inheritance And Estate Taxes Ibekwe Law

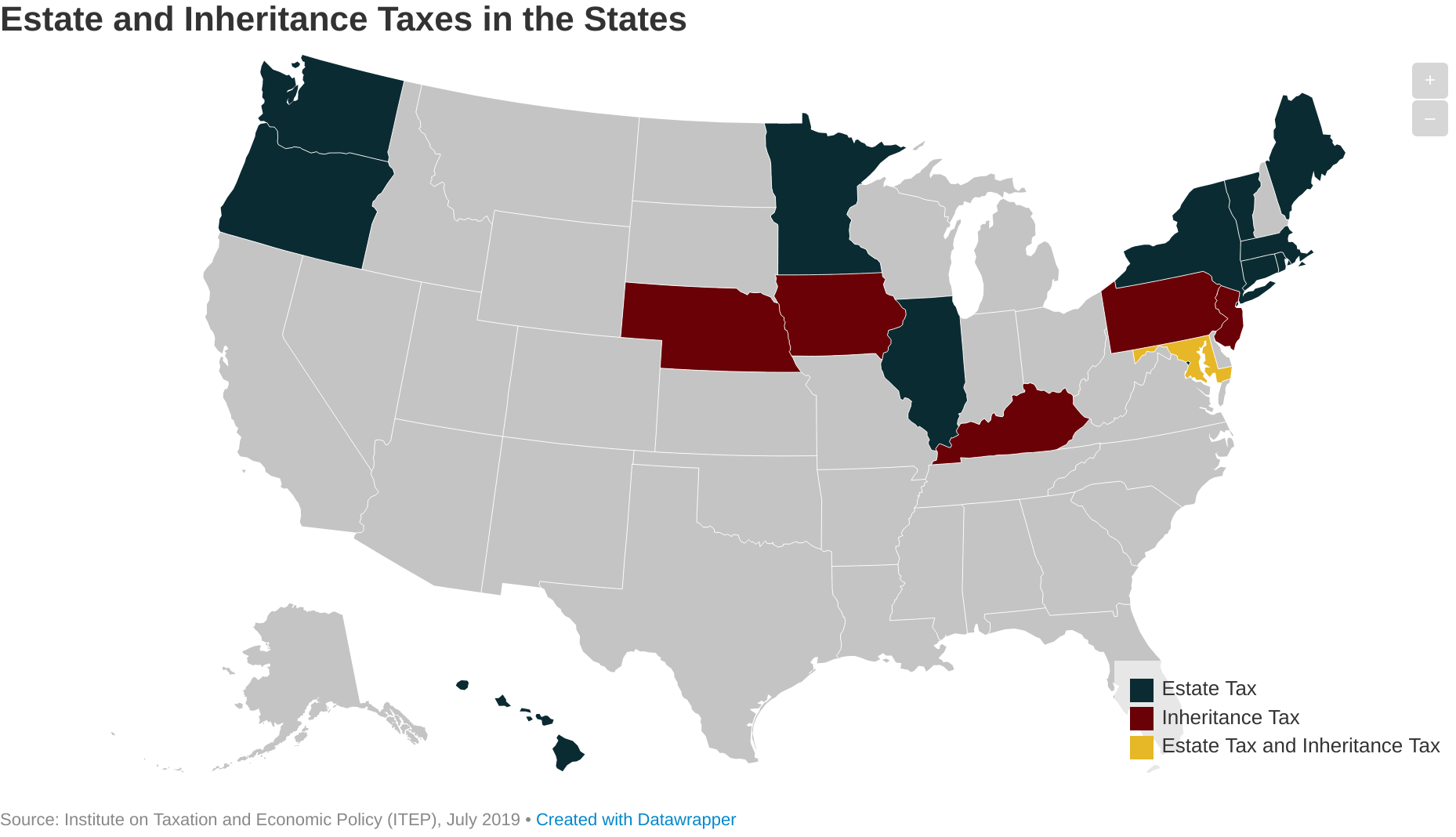

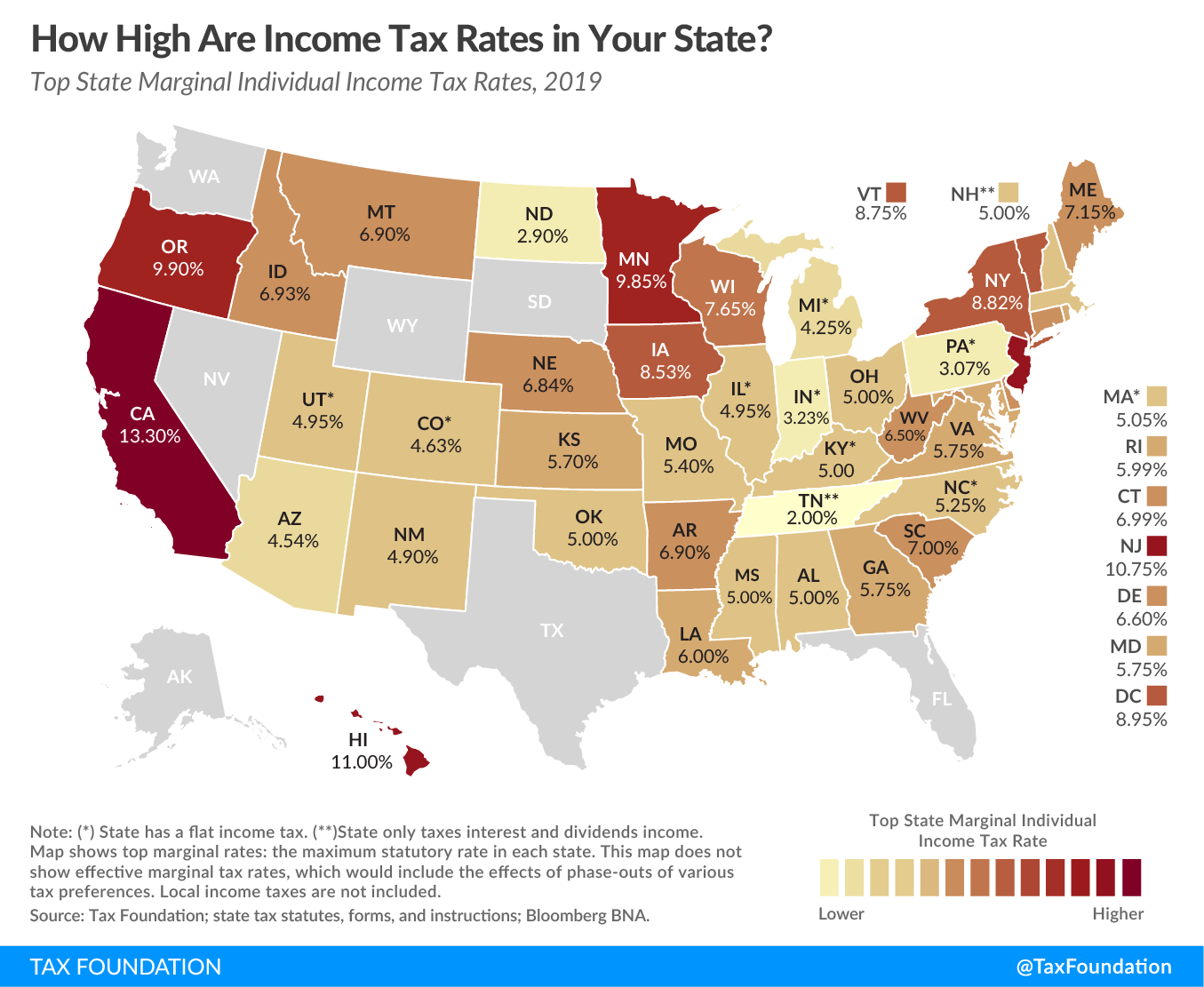

In addition to the federal estate tax of 40 percent some states levy an additional estate or inheritance tax.

. Maryland whose nickname is the Free State has both. The due date is the same as the federal due date 9 months after the date of death. The state of Texas does not have an inheritance tax.

So only very large estates would ever need to worry about this tax becoming an issue. However this is only levied against estates worth more than 117 million. The federal government of the United States does have an estate tax.

Each are due by the tax day of the year following the individuals death. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. The federal government does not impose an inheritance tax so the recent tax changes from the Trump administration did not affect the inheritance taxes imposed by the states.

There is also no inheritance tax in Texas. There is a 40 percent federal tax. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger.

Currently twelve states have estate taxes with some exemptions being as low as 1 million. His assets were held in a living trust that became an irrevocable trust upon his death. If no Federal estate tax return is required to be filed no Georgia filing is required.

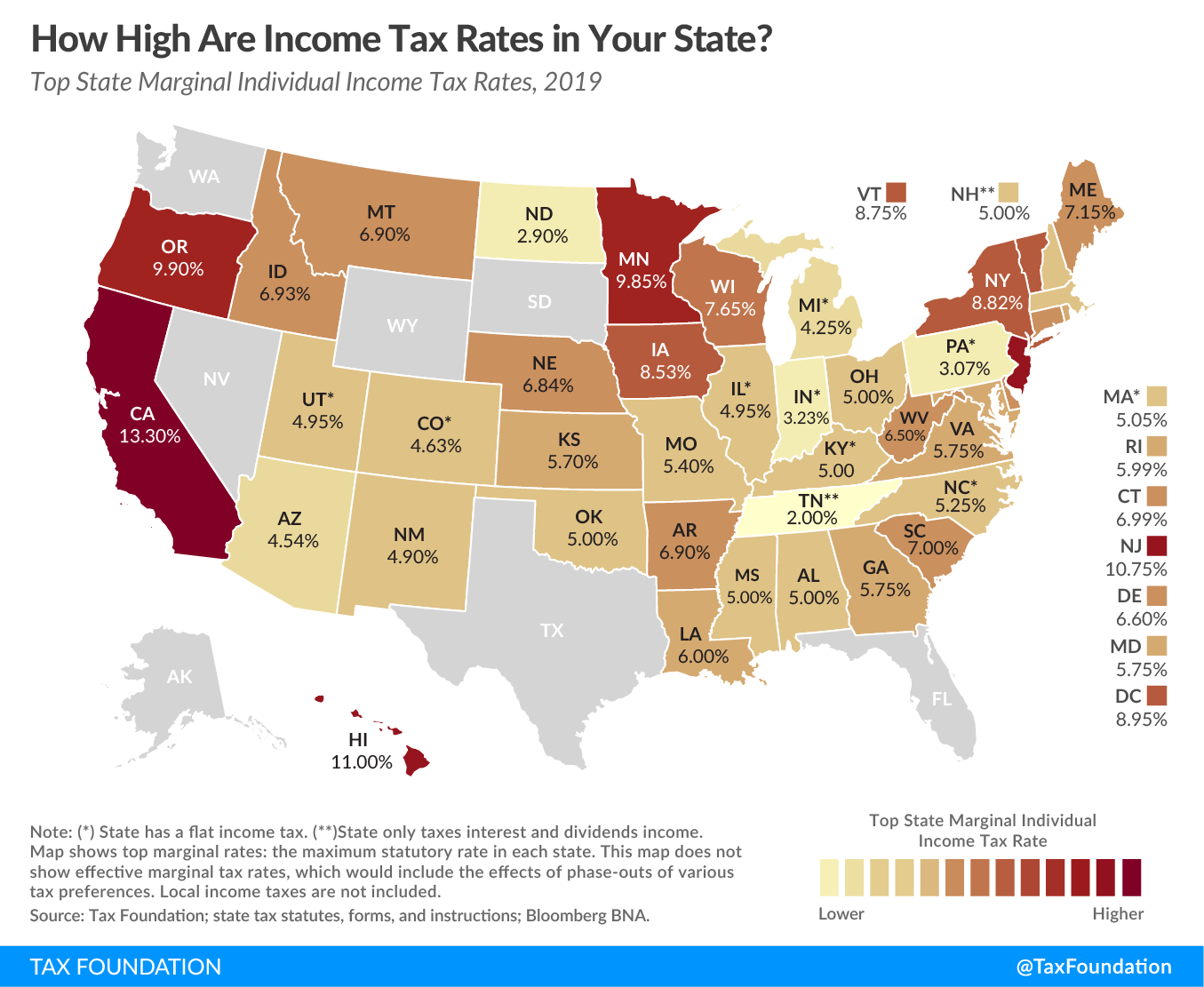

TC-44R not currently available Statutes. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. The IRS did however change the federal estate tax exemption from 2018 to 2019 from 1118 million to 114 million.

As of 2019 only twelve states collect an inheritance tax. No estate tax or inheritance tax Vermont. With the elimination of the federal credit the Virginia estate tax was effectively repealed.

In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. The state business return is not available in TurboTax. Theres no personal property tax except on property used for business purposes.

If you have a loved one who dies in Pennsylvania and leaves you money you may owe taxes to. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive. However certain remainder interests are still subject to the inheritance tax.

The federal government does not have an inheritance tax. In addition six states have inheritance taxes. Like the inheritance tax you need to be aware of the laws of states in which you have real property as you could have exposure to that states estate tax.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. You must file a copy of the federal return with payment for the Georgia tax. However inheritanceestate tax is not administered by the Illinois Department of Revenue.

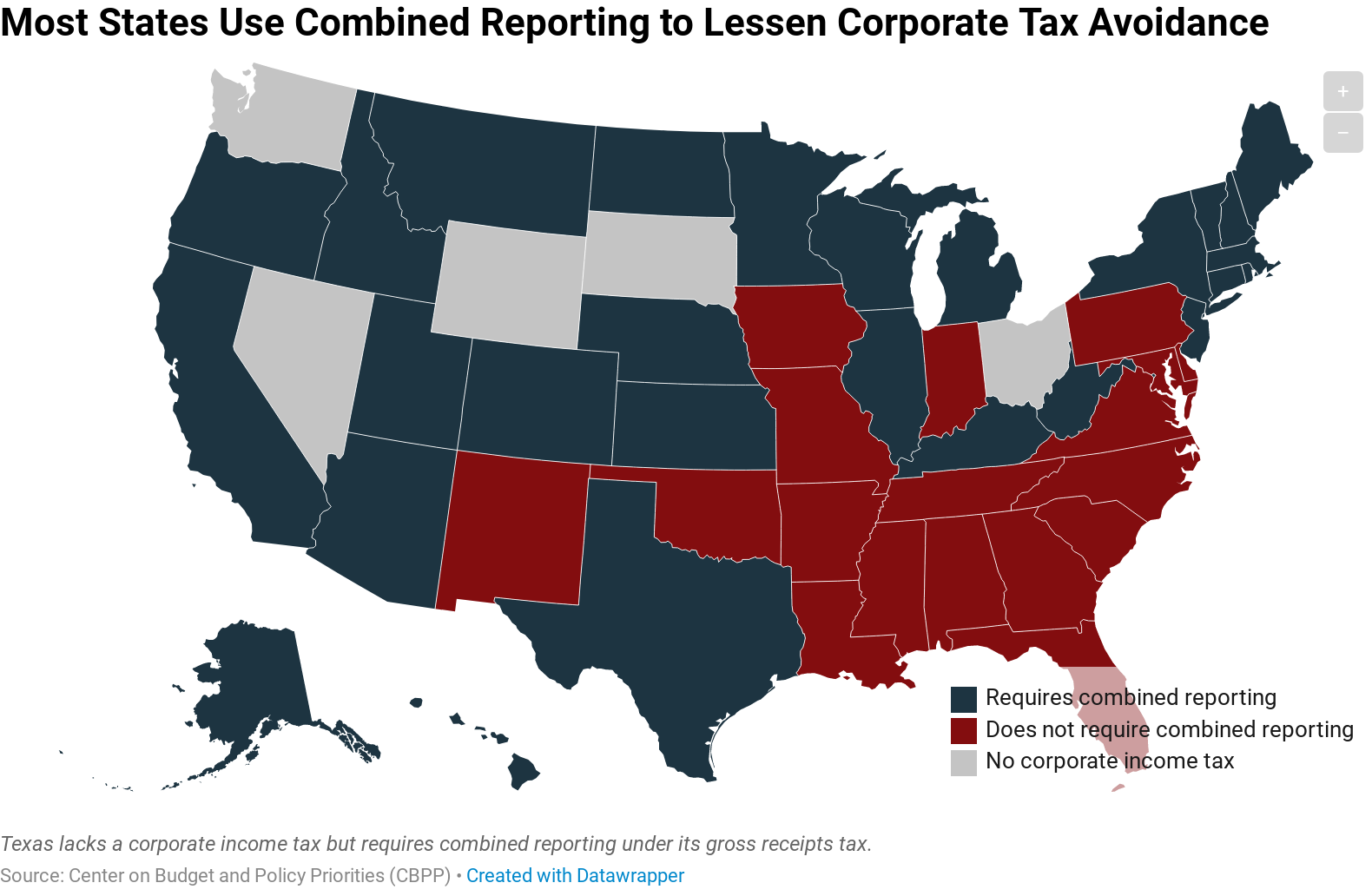

However other states inheritance taxes may apply to you if a loved one who lives in those states gives you money so make sure to check that states laws. Federal legislation passed in 2001 authorizes the elimination of the federal estate and gift tax by 2009. Final individual federal and state income tax returns.

This is because Utah picks up all or a portion of the credit for state death taxes allowed on the federal estate tax return federal form 706 or 706NA. Does Your State Have an Estate or Inheritance Tax. Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes.

There are no inheritance or estate taxes in Texas. No estate tax or inheritance tax Utah. Its inheritance tax was repealed in 2015.

The state repealed the inheritance tax beginning on September 1 2015. State Inheritance Taxes. Questions regarding inheritance tax should be directed to the Office of the Attorney General at 217 524-5095 or you may visit their web site at.

Georgia does not have an estate tax form. Inheritance Tax Law Changes. For example in Pennsylvania there is a tax that applies to out-of-state inheritors.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. And in. Utahs estate tax system is commonly referred to as a pick up tax.

Return to Tax Listing. Maryland is the only state to. The inheritance tax is paid out of the estate by the executor.

Inheritance taxes which are calculated based on who inherits the estate as opposed to the overall value of the estate are currently collected in the states of Iowa Kentucky Maryland Nebraska New Jersey and PennsylvaniaNotice that Maryland and New Jersey collect both state estate taxes and inheritance taxes. That said you will likely have to file some taxes on behalf of the deceased including. As a result of the federal tax changes enacted in 2001 estates where the.

An inheritance tax is a tax based on what a beneficiary actually receives from an estate. Alabama Fiduciary Estate Inheritance Tax. Today Virginia no longer has an estate tax or inheritance tax.

Alabamas filing requirement is based on the federal estate tax credit allowed under the federal estate tax law. The top estate tax rate is 16 percent exemption threshold. Texas also imposes a cigarette tax a gas tax and a hotel tax.

In Texas the median property tax rate is 1692 per 100000 of assessed. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. Texas has no income tax and it doesnt tax estates either.

For instance if Mom and Dad die with 3000000 in their estate but they have three children who each inherit 13 of that estate 1000000 then each of the children may pay an inheritance tax on the 1000000 received if they live in a state which has an inheritance tax. The state of Texas is not one of these states. The 1041 federal return was for the estate of my father who died in the middle of 2018.

The sales tax is 625 at the state level and local taxes can be added on. Finding Information About Taxes On Interest An initial gift of money or property is tax-free but if. The tax rate varies depending on the relationship of the heir to the decedent.

Does Illinois have an inheritance estate tax.

How Do State And Local Sales Taxes Work Tax Policy Center

Texas State Taxes Forbes Advisor

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Most Important Texas Inheritance Laws Explained Here Halt Org

Talking Taxes Estate Tax Texas Agriculture Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With Highest And Lowest Sales Tax Rates

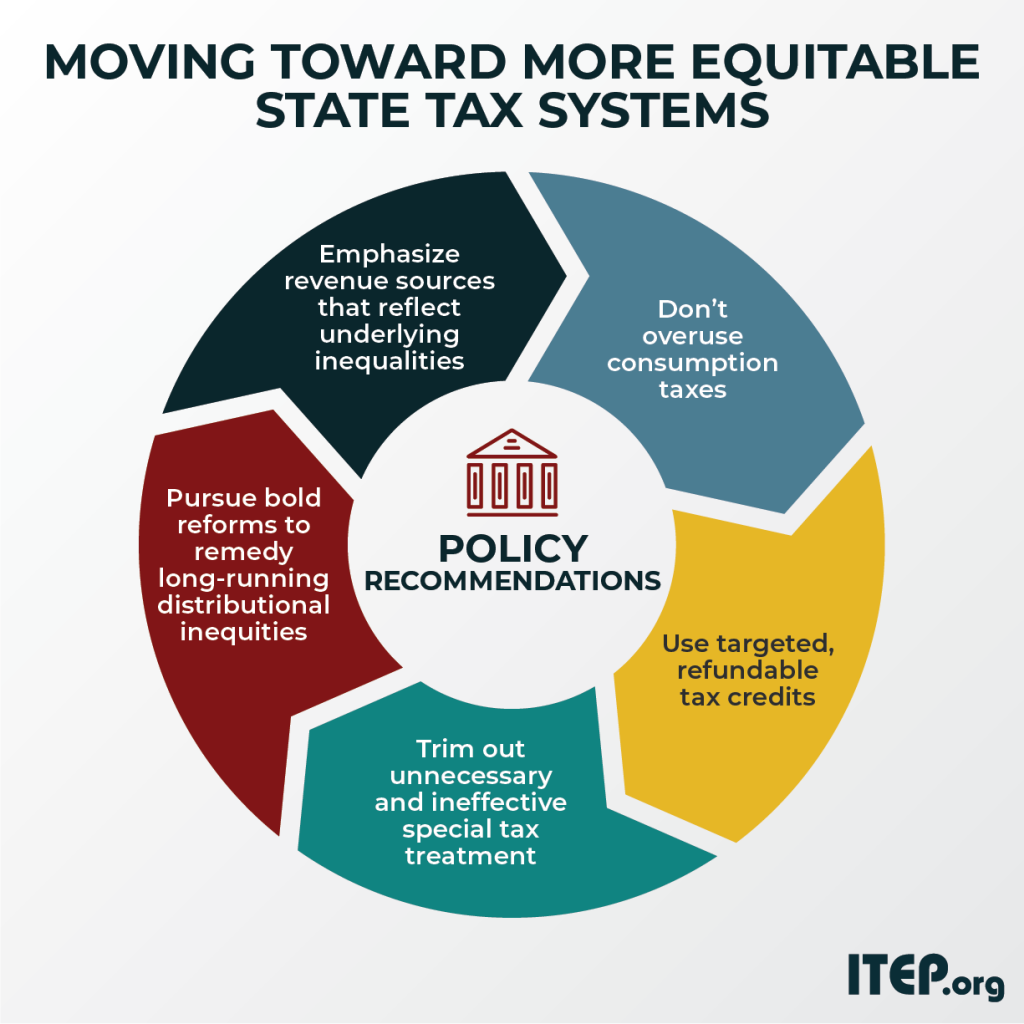

Moving Toward More Equitable State Tax Systems Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Us State Tax Planning Gfm Asset Management

Here S Which States Collect Zero Estate Or Inheritance Taxes

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Recent Changes To Estate Tax Law What S New For 2019

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Do All Wills Have To Go Through Probate In Texas The Law Offices Of Kyle Robbins